Automatic Data Processing, Inc. is one of the world’s leading technology companies providing comprehensive cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, tax and benefits administration.

ADP’s business model can generate a lot of cash flow with a minimal capital expenditure. Its profitability is in class-first level.

From 2021FY to 2023FY,ADP’s total revenues increased to $18 billion from $15 billion.

There is not a question that this is a growing market.

From 2022FY to 2023FY, ADP’s net income was $3.4 billion, $2.95 billion and $2.6 billion with net operating cash of $4.2 billion, $3.1 billion and $3.1 billion.

ADP’s total revenues were $14.4 billion in the nine months ended to March 31, 2024, an increase of approximately 6.7%, compared with $13.5 billion in the nine months to March 31, 2023.

In balance sheets, ADP keep a moderate level of debt. You know that many companies tend to borrow money to repurchase shares, which make balance sheets under great pressure.

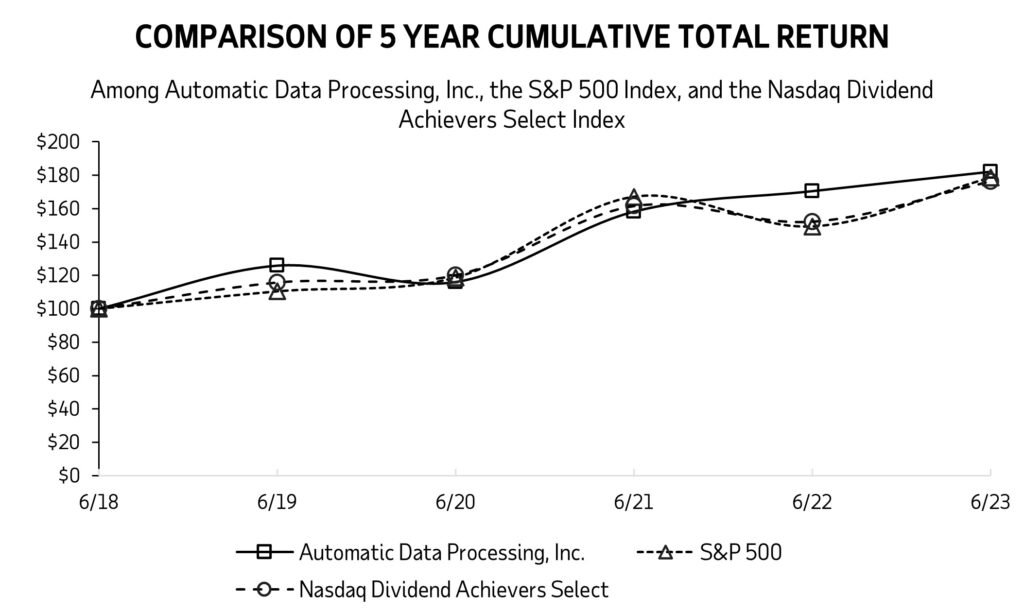

In capital return, ADP returned substantial capital to shareholders in dividends and repurchase stock.

ADP is a excellent company. We think that the company’s reasonable valuation is about $70 billion, while ADP stock price is $238.02 per share, which is equivalent to $97.4 billion in market capitalization.

Disclaimer: The content is for reference only and does not constitute investment advice.