Introduction

AES remains an industry leader in developing and operating the innovative solutions that enable the transition to zero and low-carbon sources of energy. We continue to see an enormous opportunity from the once-in-a-lifetime transformation of the electricity sector driven by decarbonization, electrification, and digitalization.

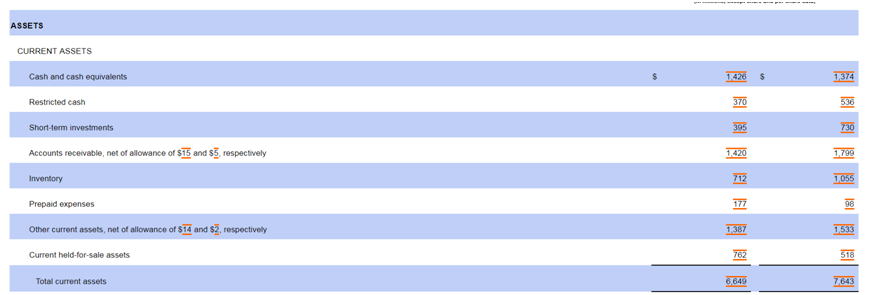

Asset Structure Analysis

AES’ total assets were $44.8 billion as of December 31, 2023, up from $38.36 billion as of December 31, 2022.

Property, plant and equipment, net were $29.96 billion as of December 31, 2023, accounting for 66.9% of total assets.

Total current assets were $6.65 billion as of December 31, 2023, making up 14.8% of total assets.

Of total current assets, cash and cash equivalents were $1.43 billion, accounts receivable were $1.42 billion, inventory is $712 million and other current assets were $1.39 billion.

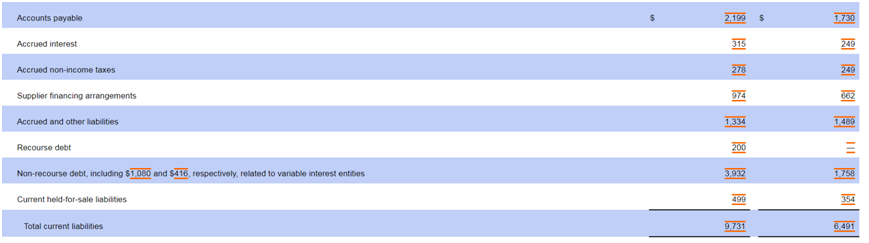

Liquidity and Solvency

Total current liabilities were $9.73 billion as of December 31, 2023.

The current ratio was 0.68 for 2023, which is very low.

Total liabilities was $38.8 billion for fiscal 2023.

The debt ratio was 86.6% for 2023.

Profitability Analysis

AES’ total revenues were $12.67 billion, $12.62 billion and $11.14 billion in 2023, 2022 and 2021, respectively.

The fix assets’ operating efficiency is very poor.

As you can see, property, plant and equipment, net were $29.96 billion as of December 31, 2023, so each dollar of fixed asset generated less than $0.50 in revenue.

Net loss was $182 million, $505 million and $951 million in 2023, 2022 and 2021, respectively.

Cash Flow Analysis

Net cash provided by operating activities was $3 billion, $2.7 billion and $1.9 billion in 2023, 2022 and 2021, respectively.

AES’ capital expenditure is very huge.

The capital expenditure was $7.7 billion, $4.55 billion and $2.1 billion in 2023, 2022 and 2021, respectively.

As you can see, capital expenditure eat up all cash flow from operations.

Conclusion

The fixed asset’s operating efficiency is very poor, and AES has a lower level of profitability.

The company’s cash flow from operations is swallowed by capital expenditures.

We don’t see AES’ investing value, and the power electric industry is not a good investment.

Disclaimer: The content is for reference only and does not constitute investment advice.