Profitability analysis

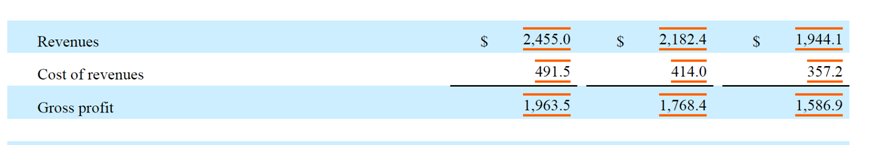

CoStar Group ‘s revenues were $2.46 billion, $2.2 billion and $1.9 billion in 2023, 2022 and 2021, respectively.

CoStar Group’s revenue in 2023 was up 11.8% year-on-year.

CoStar Group’s revenue in 2022 was up 15.8% year-on-year.

The company ‘s net income was $375 million, $370 million and $293 million for 2023, 2022 and 2021, respectively.

CoStar Group’s net profit margin was 15.2%, 16.8% and 15.4% in 2023, 2022 and 2021, respectively.

Cash flow analysis

Net cash provided by operating activities was $490 million, $479 million and $470 million in 2023, 2022 and 2021, respectively.

It is obvious that the amount of cash flow has been more than that of net income over the past three years, which illustrate that the quality of earnings was high.

Net cash used in investing activities was $239 million, $69 million and $381 million in 2023, 2022 and 2021, respectively.

We think that the amount of net cash provided by operating activities subtracting that of net cash used in investing activities is disposable cash flow, which can be used by repurchasing stock and paying dividends to shareholders.

Over the three years, the company has never repurchasing common stock and paid dividends to shareholders.

Balance sheet analysis

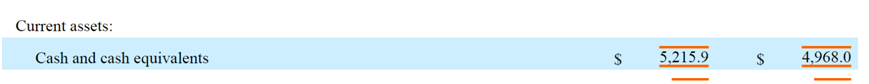

CoStor Group’s total assets were $8.9 billion and $8.4 billion in 2023 and 2022, respectively.

It is amazing that in 2023 , the company has $5.2 billion in cash and cash equivalents, accounting for 58% of total assets.

Goodwill was $2.38 billion in 2023, comprising 26.7% of total assets.

The company’s total liabilities were $1.58 billion in 2023.

We get a debt ratio : 17.8%, which is extremely low.

We can responsibly say that its balance sheet is very healthy.

Conclusion

The company can develop business by acquiring other company, and the company has a lot of cash.

The debt ratio was very low.

Now , CoStar Group ‘s stock price is $ 96.6 per share, which is equivalent to $39.45 billion in market cap.

We reckon that at $10 billion in market cap($24.5 per share) is profitable to buy.

Introduction

CoStar Group, founded in 1987, is a leading provider of online real estate marketplaces, information and analytics in the U.S. and U.K. based on the fact that we own and operate leading online marketplaces for commercial real estate and apartment listings in the U.S., based on the numbers of unique visitors and site visits per month; provide more information, analytics and marketing services than any of our competitors; offer the most comprehensive commercial real estate database available; and have the largest commercial real estate research department in the industry. We have created and compiled a standardized platform of information, analytics and online marketplace services where industry professionals and consumers of commercial real estate, including apartments, and the related business communities, can continuously interact and facilitate transactions by efficiently accessing and exchanging accurate and standardized real estate-related information. Our service offerings span all commercial property types, including office, retail, industrial, multifamily, land, mixed-use and hospitality. Through our Homes.com Network and our acquisition of OnTheMarket, we also offer online platforms that manage workflow and marketing for residential real estate agents and brokers and provide portals for homebuyers to view residential property listings.(from CoStar Group ‘s form 10k)