Introduction

McDonald’s Corporation franchises and operates McDonald’s restaurants, which offer locally inspired, high-quality food and beverage menus in communities in more than 100 countries. As of the end of 2023, there were 41,822 McDonald’s restaurants, of which approximately 95% were franchised restaurants.

Asset Structure Analysis

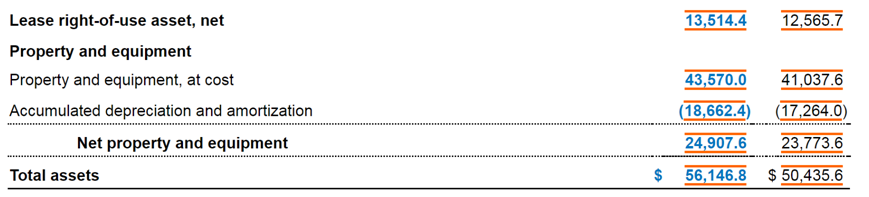

McDonald’s Corporation’s total assets were $56.15 billion as of December 31, 2023, up from $50.44 billion as of December 31, 2022.

Property and equipment, net were $24.91 billion as of December 31, 2023, accounting for 44.4% of total assets.

Lease right-of-use asset, net was $13.51 billion as of December 31, 2023, making up 24.1% of total assets.

It is normal that the amount of property, equipment, net and lease right-of-use asset, net is very huge, which depend on the company’s business model.

Total current assets were $8 billion as of December 31, 2023, composing 14.2% of total assets.

Of total current assets, cash and cash equivalents were $4.58 billion, and accounts and notes receivable were $2.49 billion.

Liquidity and Solvency Analysis

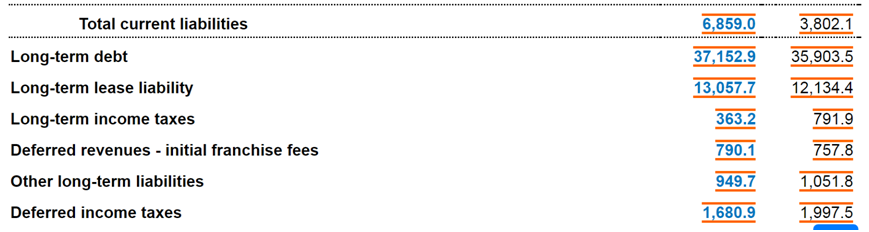

Total current liabilities were $6.86 billion as of December 31, 2023.

The company’s current ratio was 1.16.

Long-term debt was $37.15 billion as of December 31, 2023.

McDonald’s Corporation’s liquidity and solvency mainly rely on its cash flow. We think that the company can maintain debt ,but the debt level may have reached its peak.

Profitability Analysis

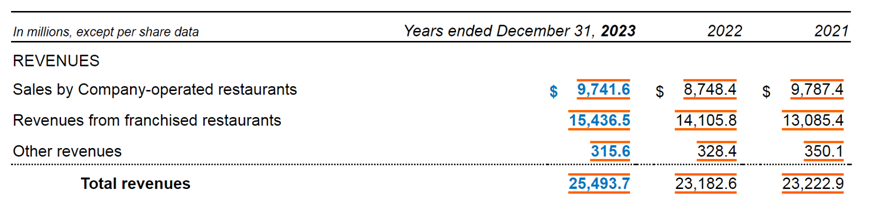

In 2023, McDonald’s has three reportable segments: company-operated restaurant sales ($9.74 billion), franchised restaurant revenue ($15.44 billion), and other revenue.

Total revenue was $25.5 billion, $23.18 billion and $23.22 billion in 2023, 2022 and 2021, respectively.

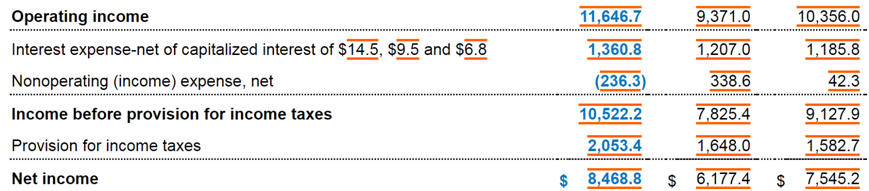

Operating profit was $11.65 billion, $9.37 billion and $10.36 billion in 2023, 2022 and 2021, respectively.

Net income was $8.47 billion, $6.18 billion and $7.55 billion in 2023, 2022 and 2021, respectively.

The return on asset was 15.1% and 12.35 in 2023 and 2022,respectively.

Cash Flow Analysis

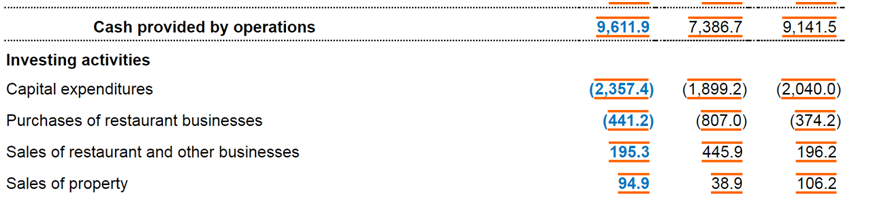

Cash provided by operating activities was $9.61 billion, $7.39 billion and $9.14 billion in 2023, 2022 and 2021, respectively.

Capital expenditures were $2.36 billion, $1.9 billion and $2.04 billion in 2023, 2022 and 2021, respectively.

The company’s free cash flow was $7.25 billion, $5.49 billion and $7.1 billion in 2023, 2022 and 2021, respectively.

McDonald’s Corporation returned to shareholders through stock repurchases and dividends.

Treasury stock repurchases were $3.05 billion, $3.9 billion and $850 million in 2023, 2022 and 2021, respectively.

Common stock dividends were $4.53 billion, $4.17 billion and $3.92 billion in 2023, 2022 and 2021, respectively.

It is important to note that McDonald’s Corporation repurchased its shares by increasing debt. If McDonald’s Corporation repays its debt, the amount of stock repurchased will decrease.

McDonald’s Corporation’s operating performance for Q1 2024

Revenues were $6.17 billion in Q1 2024, up from $5.9 billion in Q1 2023.

Net income was $1.93 billion and $1.8 billion in Q1 2024 and Q1 2023, respectively.

Net cash provided by operating activities was $2.39 billion and $2.42 billion in Q1 2024 and Q1 2023, respectively.

In Q1 2024, the company’s cash and cash equivalents plummeted due to repaying debt, and adding stock repurchases and dividends.

Conclusion

McDonald’s Corporation repurchased stock by adding debt. The debt may reach peak and the amount of stock repurchases may be in decline.

McDonald’s Corporation has a limited growth in revenues, so we could see dividends and stock repurchases as investment returns.

McDonald’s Corporation stock price is $276.69 per share, which is equivalent to $199.41 billion of market capitalization.

We reckon that the company’s stock price is overestimated and the reasonable range of valuation is $100 billion to $140 billion.

Disclaimer: The content is for reference only and does not constitute investment advice.